Lonmas NewsContact Us

Categories

Brexit's Effect on New York's Ascent as a Main Monetary Center

A new review by Duff and Phelps shows that New York has surpassed London as the main worldwide monetary focus, basically because of the repercussions of Brexit. The yearly Worldwide Administrative Standpoint study included reactions from 180 chiefs across different areas, for example, resource the executives, multifaceted investments, confidential value, banking, and business.

Members were approached to communicate their perspectives on what is an optimal monetary focus, with choices including the US, England, Ireland, Hong Kong, Singapore, and Luxembourg. North of 60% recognized New York as the top worldwide monetary center, a striking ascent from 2018 when just 10% favored it, while London's allure decreased to 17 percent from the earlier year.

Moreover, Duff and Phelps saw that 12% of respondents predict Hong Kong arising as the superior monetary focus inside the following five years, featuring a worldwide change in monetary needs.

In light of Brexit, the English government has communicated idealism about the strength of the UK monetary area. In any case, Dublin, Luxembourg, and Frankfurt have additionally seen development this year as the European Association's monetary industry looks for elective center points, as per the review.

With England's partition from the EU having confronted two postponements and another cutoff time moving toward on October 31, vulnerability perseveres in regards to future exchange relations and the capacity of resource administrators, banks, and guarantors to lay out joins with clients inside the EU market.

Members were approached to communicate their perspectives on what is an optimal monetary focus, with choices including the US, England, Ireland, Hong Kong, Singapore, and Luxembourg. North of 60% recognized New York as the top worldwide monetary center, a striking ascent from 2018 when just 10% favored it, while London's allure decreased to 17 percent from the earlier year.

Moreover, Duff and Phelps saw that 12% of respondents predict Hong Kong arising as the superior monetary focus inside the following five years, featuring a worldwide change in monetary needs.

In light of Brexit, the English government has communicated idealism about the strength of the UK monetary area. In any case, Dublin, Luxembourg, and Frankfurt have additionally seen development this year as the European Association's monetary industry looks for elective center points, as per the review.

With England's partition from the EU having confronted two postponements and another cutoff time moving toward on October 31, vulnerability perseveres in regards to future exchange relations and the capacity of resource administrators, banks, and guarantors to lay out joins with clients inside the EU market.

LATEST POSTS

- 1

The Fate of Mechanical technology: 5 Headways Forming Tomorrow

The Fate of Mechanical technology: 5 Headways Forming Tomorrow - 2

New materials, old physics – the science behind how your winter jacket keeps you warm

New materials, old physics – the science behind how your winter jacket keeps you warm - 3

San Francisco sues 10 companies that make ultraprocessed food

San Francisco sues 10 companies that make ultraprocessed food - 4

Exclusive-Head of Pemex's production arm to step down in coming days, sources say

Exclusive-Head of Pemex's production arm to step down in coming days, sources say - 5

Barn Stored Lotus Esprit Turbo Seen After 30 Years

Barn Stored Lotus Esprit Turbo Seen After 30 Years

Share this article

Survey: Protected And Versatile Men's Razor

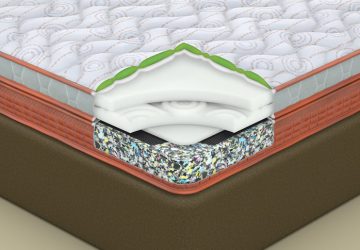

Survey: Protected And Versatile Men's Razor Beddings of 2024: Track down Your Ideal Fit for a Tranquil Rest

Beddings of 2024: Track down Your Ideal Fit for a Tranquil Rest Fundamental Home Exercise center Hardware: Amplify Your Exercises

Fundamental Home Exercise center Hardware: Amplify Your Exercises 5 Instructive Toy Brands for Youngsters

5 Instructive Toy Brands for Youngsters Massive supernova explosion may have created a binary black hole

Massive supernova explosion may have created a binary black hole Famous Restroom Beautifying Styles For 2024

Famous Restroom Beautifying Styles For 2024 Black Friday Paramount+ deal: Save 50% and stream these buzzy Taylor Sheridan shows

Black Friday Paramount+ deal: Save 50% and stream these buzzy Taylor Sheridan shows An 'explosion' of solo-agers are struggling with rising costs and little support: 'I'm flying without a net'

An 'explosion' of solo-agers are struggling with rising costs and little support: 'I'm flying without a net' The Starbucks for Life game is back, along with your chance to win a 'Bearista' cold cup. Here's how to get your paws on one.

The Starbucks for Life game is back, along with your chance to win a 'Bearista' cold cup. Here's how to get your paws on one.